Initial Private Offers for Small to Medium Sized Enterprises

Wealth is created by solving problems. If you solve a million-dollar problem, it will make you and your investors millions!

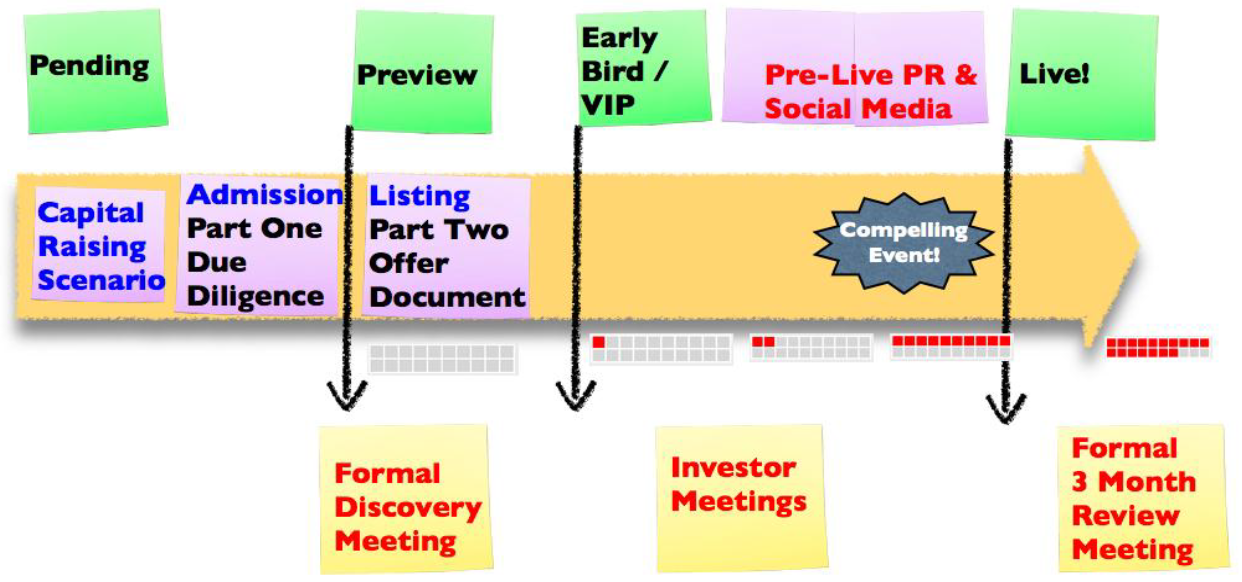

An IPrO or Initial Private Offer on the SMESX is an affordable way for a startup or early-stage company to raise equity capital. An IPrO provides a simple and legal way to make private offers to issue shares to investors.

Unlike an initial public offer, an initial private private offer to issue shares does not require the preparation of a costly product disclosure document (prospectus) to be registered with the Australian Securities & Investments Commission (ASIC).

Nonetheless, there can still be advisor fees, legal fees, document preparation fees, SMESX lodgement fees, etc. If you’re short on funds, offering Convertible SME Bonds to your early followers may be a way to cover off those initial expenses.

Your early followers would have the discretion to choose to convert to equity as the business grows, perhaps at a discounted price to your Company’s proposed IPrO share price.

Equity capital is contributed in return for a share of ownership. It’s not repayable, demands no provision of security (other than the issued shares) and bears no interest.

Before you even think about seeking outside investors, it is critical to establish the number of shares each founder will hold.

As investors come in, the quantity of shares the founders hold will always remain the same, it’s only the percentage they hold that will reduce.

The SMESX supports primary issues from your SME as well as a secondary sale platform as an exit pathway for its shareholders.

To establish an appropriate number of shares to be held by the founders of your SME you will need to have a Strategic Growth Plan (SGP) & Share Capital Structure prepared!

The Company structure is immortal (unlike its directors). It has a charter to implement its business plan for the benefit of its shareholders.

The Company structure together with the SMESX process provides the best protection to the founding owners from Vulture Venture Capitalists stealing your Company, when seeking investment.

Ideally the founders need to retain at least 51% control.

King Solomon, the richest man in Babylon once said, "you can get whatever you want in life, provided you help enough people get what they want first". If you have a passion to help people achieve their best, then we would welcome the opportunity to speak with you about becoming an SME Broker. As an SME Broker, you will have the opportunity to earn multiple income streams and you will learn how to build a profitable business while helping other business owners build theirs. At SME Brokers we believe that it's "your attitude not your aptitude that determines your altitude".